Surety Bonds

What is a surety bond?

A "surety bond" is a financial instrument that guarantees that a party, natural person or business entity (the "principal") will perform certain contractual terms, or will comply with the statutory requirements of specific professional or occupational licenses. Surety is not insurance in the traditional meaning of the word. Insurance contemplates a shift of risk from an insured to an insurance company. The insured pays the insurance company a premium (fee) for accepting his or her risk of loss. A surety bond is a third party financial guarantee of a principal's promises. There is NO shift of risk from a principal to the surety company, as there is an assumption that each principal will comply with the agreements that he or she makes. In simpler terms a surety company "wraps" the promise of a bonded principal with the good name and creditworthiness of the surety company. The following diagram may be helpful in understanding this tripartite relationship:

There are MANY surety bond obligations in current use within the northamerican market, over 85,000 by our count. The term "surety bond" is a coverall word for can reasonably be any type of third party guarantee issued by a surety company. Most obligees (parties that require that you provide a bond) will provide a specific bond form. Those that to do not often accept a generic version that contains the appropriate language. Learning about surety bonds is an ongoing pursuit by brokers that specialize in surety and by business persons that need them frequently. Follow our blog for interesting tidbits on new surety bond requirements and advice on how to obtain them.

Why would I need a surety bond?

There are two broad categories of surety bonds; contract surety bonds such as:

and there are commercial surety bonds which are typically:

The bond type that you require will depend on the type of guarantee that fits within these categories. For example, an insurance claims adjuster would require a public adjuster bond, which is a type of license and permit surety bond. A general contractor bidding on a public contract would need a bid bond which upon successful project award would also necessitate a payment and performance bond, all of which fall under the contract bond category. The easiest way to determine what type of bond that you require is to ask the party that is obligating you to provide one for either a bond form or a copy of the contract or agreement for which a guarantee is needed. The exception is the judicial bond category. Judicial bonds are generally ordered by a court or required of fiduciaries by statute such as a probate bond of an estate administrator or guardianship.

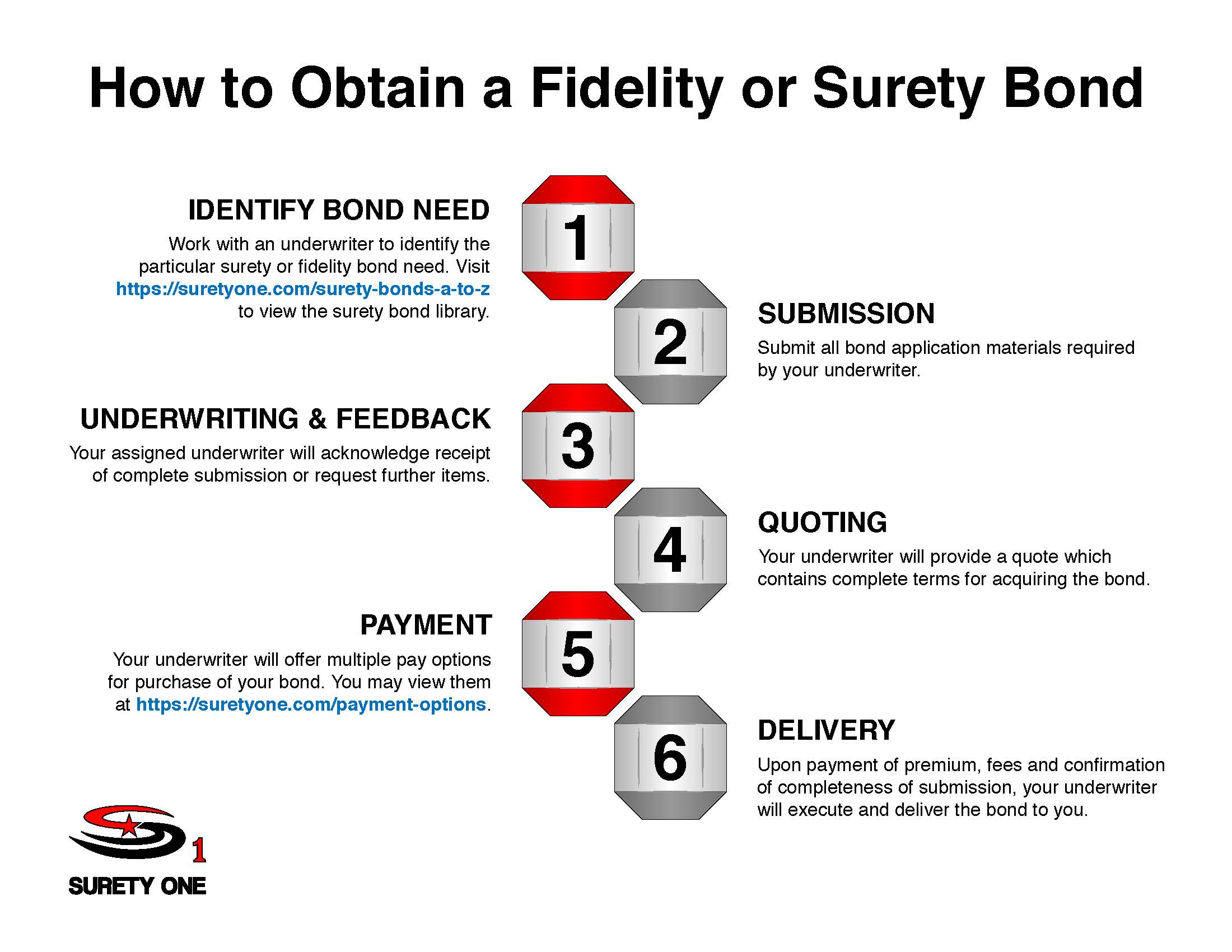

How do I obtain a surety bond?

Simple, you have a conversation with a surety bond underwriter with knowledge and experience in the sector. Surety bonding is a very special product. Bonding is considered a niche practice in the insurance sector so insurance agents that offer property, auto, home and other typical insurance products often do not understand surety underwriting and struggle to pair a client with the appropriate product. A surety specialist is best prepared to offer advice and to help a principal navigate the bond application process efficiently. If you have purchased surety bonds before and know what is required to obtain a quote, then receiving a quote is generally no more difficult than completing and submitting the appropriate application. "Bottom line", a surety bond professional will always be willing to discuss your particular need, give unbiased advice and offer terms for your bond with no obligation to purchase one if you are not comfortable with those terms. If it's not "all about you" as the client, then you are not communicating with the correct bonding company.

How much does a surety bond cost?

Pricing is a little more complicated. As mentioned before, a principal (bond applicant) retains the risk of any loss due to his or her failure to comply with the terms of his or her surety bond agreement. Therefore surety companies submit an applicant to an underwriting review. Within the industry we refer to that review as "a look at the Three Cs", meaning a subjective judgment about an applicant's character, capacity and capital position. Not all bonds require this type of in depth review. There are many bond obligations that because of their small penalties (low bond amounts), very low class loss history, or simply the volume of the class that is written, which a surety company will adjudge them "freely written" bonds. In those cases a quote may be offered with nothing more than a simple request for one. In those cases where bond language is considered onerous to the principal and surety or they contain performance and financial guarantee elements (i.e., contract bond, utility bond, etc.), then the surety underwriter will likely require an applicant to provide personal and business financial statements, asset verifications, and more. So, how does this affect "price"? Simple, lower risk = lower premium, higher risk = higher premium, unacceptable risk = premium + collateral.

Having offered the above, it's fairly easy for a surety bond underwriter to offer a "ballpark" premium estimate with only a few questions about the nature of the obligation and bond amount. Premiums for "freely written" obligations rarely carry a premium of greater than one percent (1%) of the bond penalty (bond amount). Commercial surety bonds that DO carry more risk, have a claims history or contain what the surety considers ugly language are generally quoted at two to twenty percent (2% - 20%) of the bond penalty. Personal credit IS A SIGNIFICANT FACTOR in determining where these premium amounts will fall for those obligations that are not freely written. A surety bond underwriter under these latter circumstances will offer a premium appropriate for the applicant's credit position.

Surety bonds can be discounted! There are circumstances under which a surety company may offer discounting of standard pricing for your particular bond class. Clients with multiple bonds, a long history with the surety or the prepayment of multiple years of premium may merit a downward deviation from standard rates.

How do I choose a bonding company from among the many?

Surety bond rates (i.e., the amount that you pay in premium for a particular bond) are generally "filed rates". That means that the surety (insurer) has publicly filed the prices that it charges for its bonds. When a surety company decides to go in to business in a particular state it generally reviews the filed rates of other surety companies and/or follows the rates published by the SFAA. In the case of the former, a surety invariably files what is know as a "me too". In other words, "See that those other sureties charge? Well, me too!" Being the case that rates are approximately the same withing the industry, competition on price is not necessarily the benchmark for choosing a bond underwriter. Bonding companies that are truly professionals in the business compete on service. Supportive and helpful bonding companies make the conversation about you. SUPERLATIVE bonding companies NEVER SAY NO to a bond request, NEVER! You should be able to communicate with a surety bond professional when it is convenient to YOU, receive respectful and helpful treatment and receive a fair quote for your need without any obligation to purchase if you choose not to do so. Further, surety bond specialists have access to special programs such as the SBA Surety Bond Guarantee Program which can enhance a principal's ability to obtain bonding for contract needs. Access to the Small Business Administration guarantees can ONLY be accomplished through a bondsman that has been approved by the SBA to offer it.

WHO ARE THE BIG DOGS IN THE SURETY BOND SECTOR? Click here.

National surety bond leader, Surety One, Inc. is a specialist in providing for the bonding needs of professionals in every field. We offer surety bonds ato all applicants in every state, Puerto Rico, US Virgin Islands and Canada. Call (800) 373-2804, email Underwriting@SuretyOne.com or click here for a live chat regarding a your particular surety need.

Surety bond application review and quoting are free of charge. There is no obligation to purchase.